How to create a monthly household budget on Universal Credit

A guide to help make your experience with Universal Credit a little different.

Discover all episodes

- Episode One – What is Universal Credit?

- Episode Two – How to use a benefits calculator to check Universal Credit entitlement

- Episode Three – How to apply for Universal Credit in 2021 | Step-by-step guide

- Episode Four – How to get paid fortnightly on Universal Credit

- Episode Five – Five practical Universal Credit tips with Perth Citizens Advice ft. Fraser Millar

- Episode Six – How to create a monthly household budget on Universal Credit

- Episode Seven – Get £100 towards Universal Credit uplift with Nationwide

- Episode Eight – How to apply for warm home discount in Scotland and save £140 on your winter energy bill

When we budget, what are we hoping to achieve in our daily lives?

Before we begin to work on our budget, it might be helpful to get in touch with our deeper motivations so that we have a good chance at sustaining our financial goals over the long term and achieve the vision we set for ourselves.

With this in mind, let’s get started

- First, let’s gather our monthly finances together (i.e. rent, utilities, child care, etc) so we can access them quickly and easily.

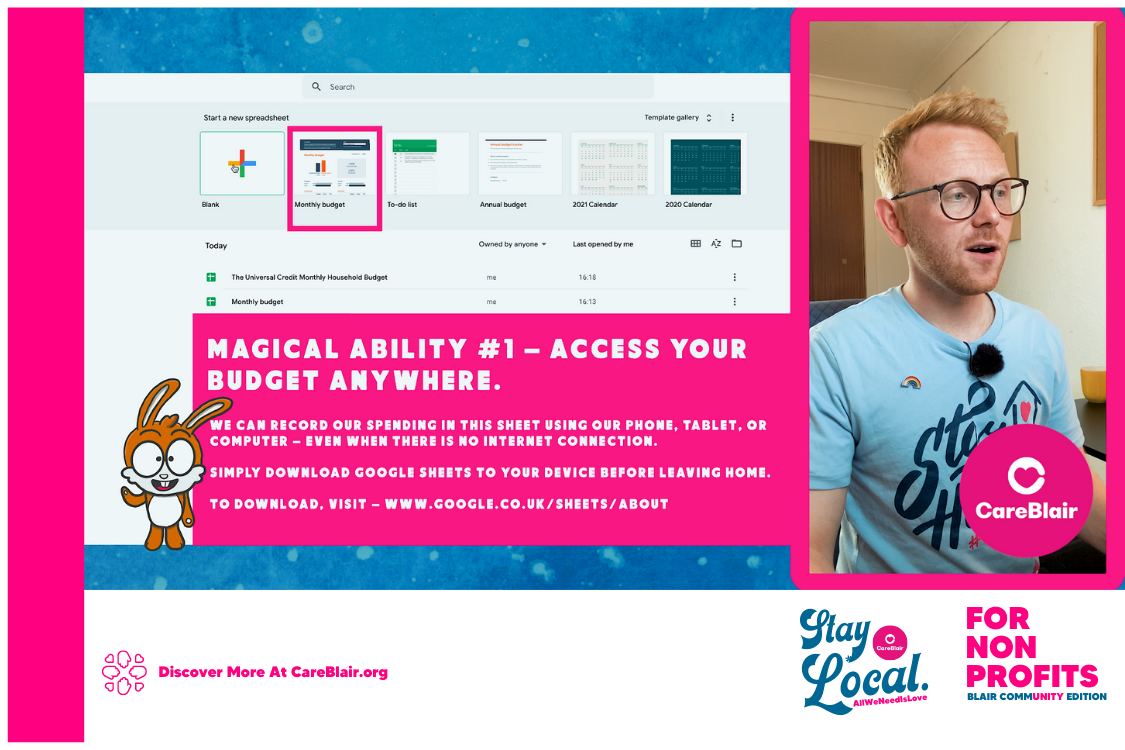

- Log into Gmail or set up your free account if you haven’t got one. This video shares how to do that.

- Once in, click on the dotted square in the top right corner of the screen, scroll down to ‘Sheets’, or simply click here.

- Last but not least, on the Google Sheets homepage, click on the ‘Monthly Budget’ template to get started!

- Click here if you’d like to view or download our Google Sheet to refer to for inspiration. Enjoy!

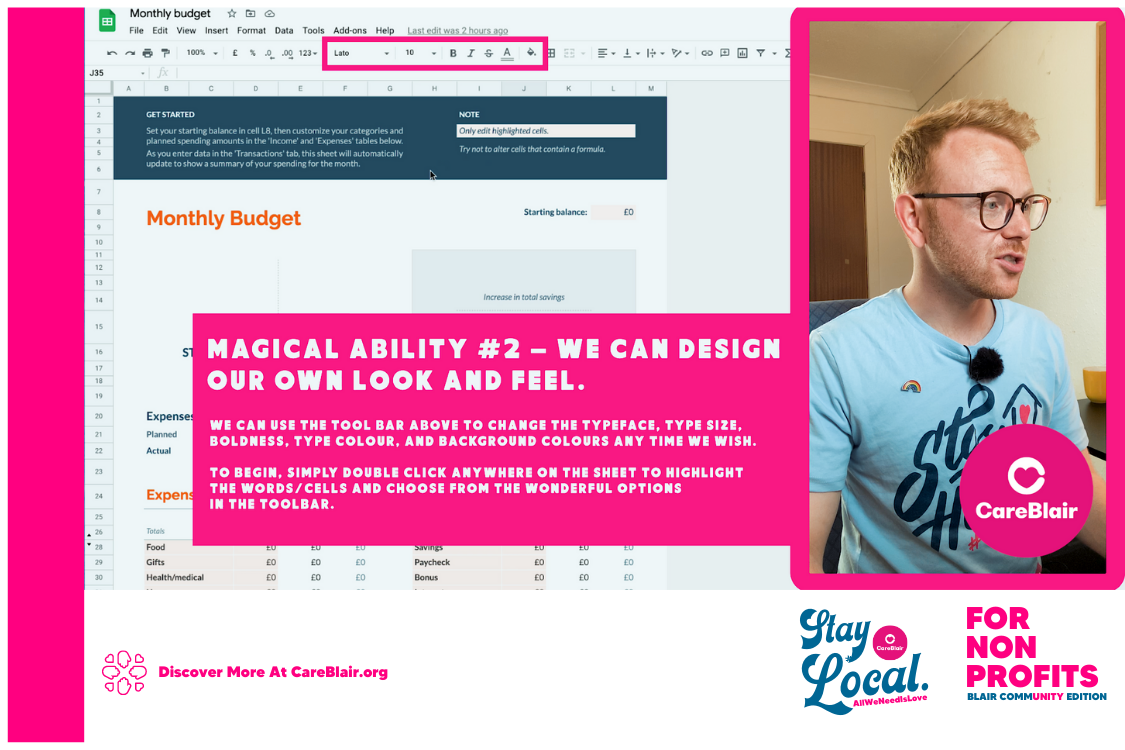

Customizing the look and feel

Use the toolbar above the sheet to change the typeface, type size, boldness, type colour, and background colours at any time.

- Double click a cell to highlight a word or number.

- While it is still highlighted, select the styling options you’d like from the toolbar.

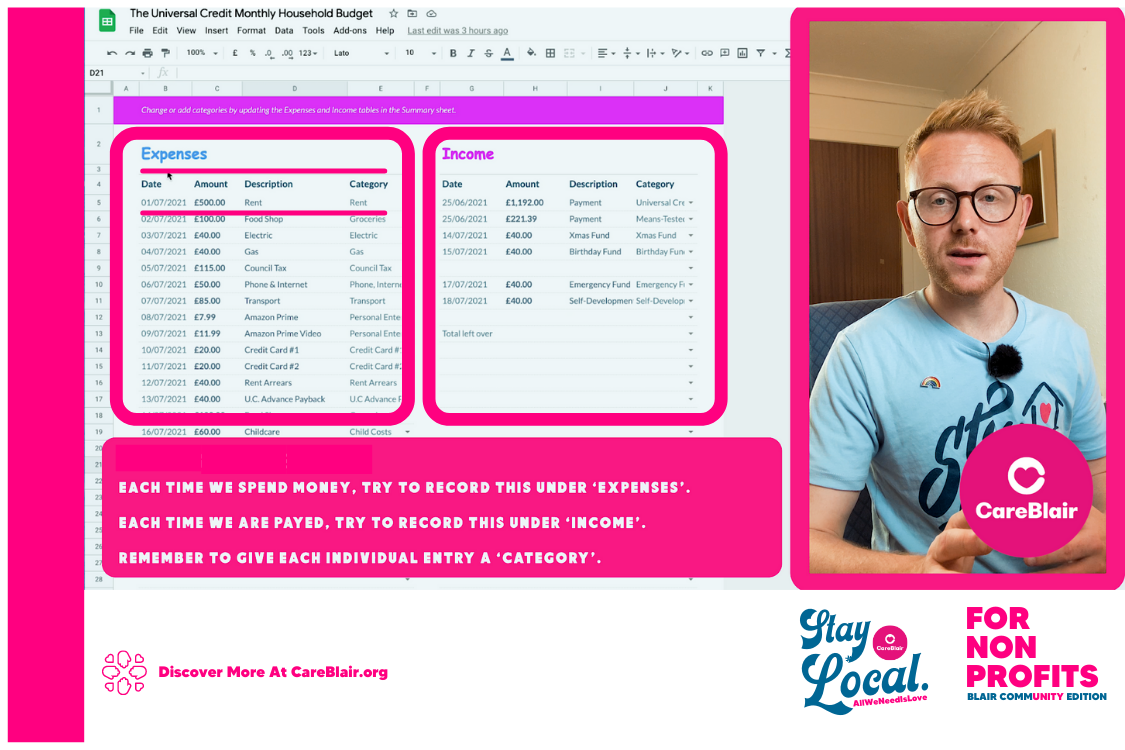

Adding our expenses

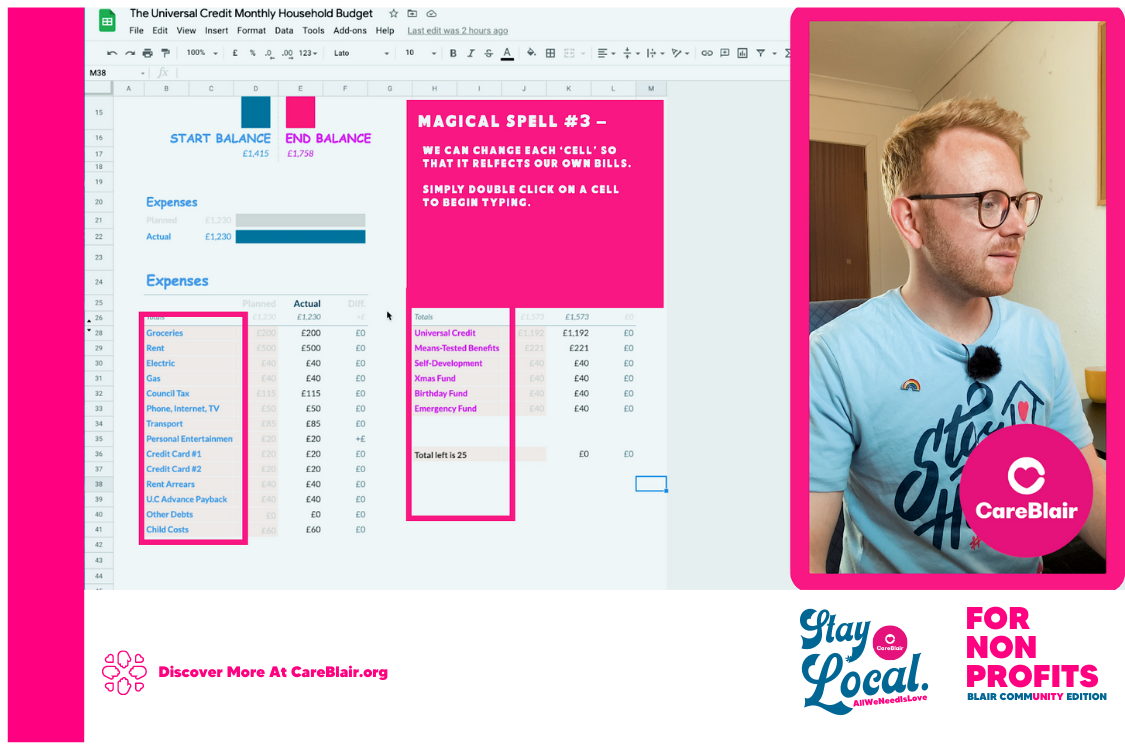

The pink box on the left is our ‘bills’ or ‘expenses’ column. Be sure to add your own bills to each cell. Try to list them all.

Since this is a ready-to-use template, we’ll notice that some cells are already populated with words or numbers.

- Double click a cell to highlight a word or number.

- Our costs go into the ‘planned’ column.

- Only edit the cells highlighted in orange. Ignore the ‘Actual’ or ‘Diff’ columns, for now.

Adding our income

In exactly the same way as we did with our expenses, let’s pop in our income under ‘planned’. Remember to be honest with yourself and to include:

- Universal Credit amount. (monthly)

- Means-tested benefits amount. (monthly)

- How much we’re putting in our emergency fund. (monthly)

- How much we’re putting aside to cover the costs of birthdays and Christmas/holidays. (monthly)

- How much we’re willing to invest in our self-development fund. (monthly)

Think of the self-development fund as a growing pot of money that can be used to buy books, online courses, and even counseling sessions that help us to become our best selves.

Just like our bodies need regular physical exercise, our minds need regular mentor-cise.

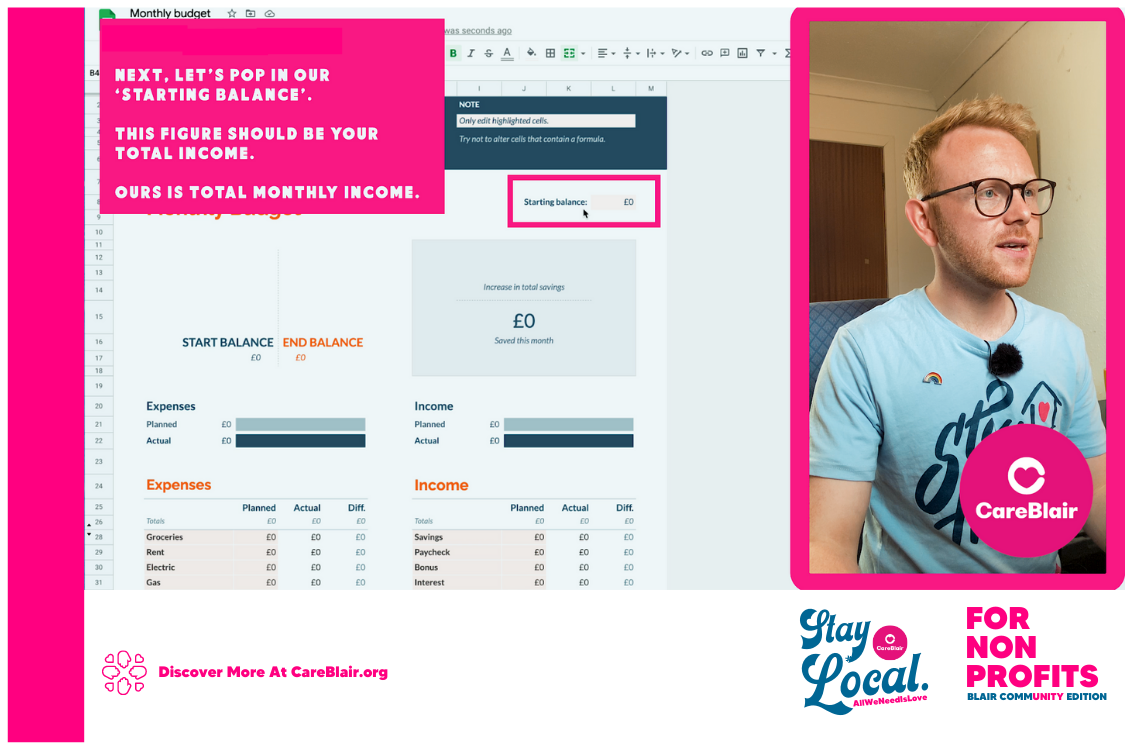

Add your starting balance

To find our starting balance, simply access our online banking or any physical statement that shows our most recent payments of Universal Credit AND means-tested benefits (i.e. Child benefit, Council tax reduction, Scottish Child Payment, etc).

We’re basing our Universal Credit payment amount on a 25-year-old single parent mother with a four-year-old daughter. She is unemployed and lives in privately rented accommodation with two bedrooms and has not claimed benefits before.

The Gingerbread calculator estimates her monthly universal credit to be £1,192 and her monthly means-tested benefits (includes child benefit, council tax reduction, and Scottish child payment) to be around £221.00.

We’ll notice, after adding our starting balance that the Google Sheet magically begins showing us various calculations. Don’t worry, this is normal, and we don’t need to do anything more.

Track your spending

Scroll down to the bottom of the Google Sheet and we’ll discover two tabs. Summary and Transaction. Let’s choose the transaction tab for our next step.

Maybe this looks something like a ‘diary’ to us? That’s because it kinda is. But instead of recording our thoughts, we’ll be recording our spending.

This is where, each day, we take 10-15 minutes or however long we wish to physically record any income and expenses we had.

Why? Because, when we do this each day for 1-4 weeks, we’ll soon begin to see where our money is going.

This then gives us clarity and empowers us to make small, simple, and calculated changes.

Can we reduce our spending?

Let’s say we began this budget at the beginning of the month and had ‘planned’ to only spend £20 on ‘personal entertainment’.

Then, out of nowhere, our temptations got the better of us and we ended up splashing out a further £20 on a trip to the cinema.

If we’ve been recording our daily expenses and income in the ‘transactions tab’ then we should see this reflected in our Google Sheet as shown below.

It clearly shows us that we’ve overspent by £20.

Can we imagine the difference that a simple budget like this could bring to our lives each month?

Resources

- Discover if you can claim a BUDGETING ADVANCE

- FREE COURSE by MoneySavingExpert & OpenUniversity – How to manage our money.

- Discover if you can get help to pay for DAILY ESSENTIALS

- Work Out Your Budget With Citizens Advice

- Low-Income Support

- Financial Support for students

Thanks for being here :)

Hopefully, you’ll feel a sense of empowerment after reading this and I bet a cuppa tea or something good like that is also on your mind?

We really hope you’ve gained some value from discovering more about why it’s a good idea to connect our budget to our deeper purpose.

Month One is all about understanding where our money is going and Month two is all about using that understanding to take simple actions that help to create the change we want to see in our lives.

So remember to shine your own light, and if you have any questions, please feel free to reach out on social media or email and we’ll do our best to get back to you.

And until next time, remember, sharing is caring.